State Farm car insurance discounts can significantly reduce your premiums. From safe driving habits to vehicle features, there are many ways to qualify for savings. State Farm offers a variety of discounts tailored to your individual needs, making it a popular choice for budget-conscious drivers.

Understanding these discounts and how to maximize them is crucial to getting the best value for your car insurance. Whether you’re a new driver, a seasoned veteran, or somewhere in between, there’s a good chance you can benefit from State Farm’s discount programs.

State Farm Car Insurance Discounts: Your Guide to Savings

Looking to save money on your car insurance? State Farm offers a wide array of discounts that can significantly reduce your premiums. From good driving habits to vehicle safety features, there’s a discount for almost everyone. Let’s dive into the world of State Farm discounts and explore how you can maximize your savings.

State Farm Car Insurance Discounts Overview

State Farm offers a comprehensive range of discounts, categorized by various factors such as driving history, vehicle features, and customer profile. Here’s a breakdown of some common discount categories:

- Good Driver Discounts:Reward safe driving habits with discounts for maintaining a clean driving record. This typically includes factors like accident-free history and no traffic violations.

- Safe Driver Discounts:Similar to good driver discounts, these recognize safe driving practices. You might qualify for this discount by completing a defensive driving course or participating in a telematics program that monitors your driving behavior.

- Multi-Policy Discounts:Bundle your car insurance with other policies like home, renters, or life insurance to enjoy significant savings. This is a popular option for customers who want to simplify their insurance needs and potentially save money.

Discounts Based on Vehicle Features

State Farm recognizes the importance of vehicle safety and offers discounts for cars equipped with specific safety features. These features contribute to a safer driving experience and can potentially reduce insurance premiums:

- Anti-theft Devices:Cars with anti-theft systems, such as alarms, immobilizers, and tracking devices, are less likely to be stolen, making them more attractive to insurers and potentially qualifying for discounts.

- Airbags:Vehicles equipped with airbags, especially multiple airbags, offer enhanced safety and can qualify for discounts. This is because airbags can significantly reduce the severity of injuries in accidents.

- Daytime Running Lights:Cars with daytime running lights improve visibility, especially during daylight hours, potentially leading to fewer accidents and reduced insurance premiums.

- Eco-Friendly Vehicles:State Farm offers discounts for drivers of eco-friendly vehicles, including hybrid and electric cars. These vehicles contribute to environmental sustainability and can be more fuel-efficient, leading to lower insurance costs.

- Vehicle Age and Mileage:Newer cars often have advanced safety features and are generally considered safer than older vehicles. Similarly, vehicles with lower mileage tend to have fewer accidents and may qualify for discounts.

Discounts Based on Driving Habits

State Farm utilizes telematics programs to monitor driving behavior and offer discounts based on safe driving practices. These programs use devices or smartphone apps to track your driving habits, such as speed, braking, and acceleration.

- Safe Driving:Drivers who demonstrate safe driving habits, such as avoiding aggressive acceleration and braking, may qualify for discounts. Telematics programs can track these behaviors and provide valuable insights into your driving style.

- Low Mileage:If you drive less frequently or have a lower annual mileage, you might qualify for a discount. This is because drivers with lower mileage are statistically less likely to be involved in accidents.

- Limited Driving Hours:Drivers who limit their driving to specific hours, such as avoiding peak traffic times, may also be eligible for discounts. This is because driving during peak hours can increase the risk of accidents.

Telematics programs can offer valuable benefits, including:

- Potential Savings:Discounts for safe driving habits can lead to significant savings on your insurance premiums.

- Improved Driving Awareness:These programs can help you become more aware of your driving habits and identify areas for improvement.

- Personalized Feedback:Telematics programs often provide feedback on your driving performance, helping you track your progress and make adjustments to your driving style.

However, it’s important to consider the potential drawbacks of telematics programs:

- Privacy Concerns:Some individuals may be concerned about the privacy implications of having their driving data tracked.

- Device Installation:Installing a telematics device in your car can be a hassle for some drivers.

- Limited Availability:Not all insurance providers offer telematics programs, and the availability of these programs can vary by region.

Discounts Based on Customer Profile

State Farm recognizes the unique needs and characteristics of different customer segments and offers discounts tailored to specific groups:

- Students:Students who maintain good grades may qualify for discounts. This reflects the positive correlation between academic achievement and responsible driving habits.

- Seniors:Seniors who complete a defensive driving course or meet certain age requirements may qualify for discounts. This acknowledges the valuable experience and safe driving practices of senior drivers.

- Military Personnel:Active duty military personnel and veterans may be eligible for discounts. This is a way for State Farm to show appreciation for their service and sacrifice.

- Good Driving Records:Drivers with a history of safe driving, without any accidents or violations, are often rewarded with discounts. This reflects the importance of consistent safe driving behavior.

- Membership in Organizations:State Farm may offer discounts to members of organizations like AAA or alumni associations. This is a way to recognize and reward the loyalty of members in these groups.

- Credit Score:Your credit score can influence your car insurance premiums. Drivers with good credit scores may qualify for discounts. This is because individuals with good credit history tend to be more responsible overall, which can be associated with safer driving habits.

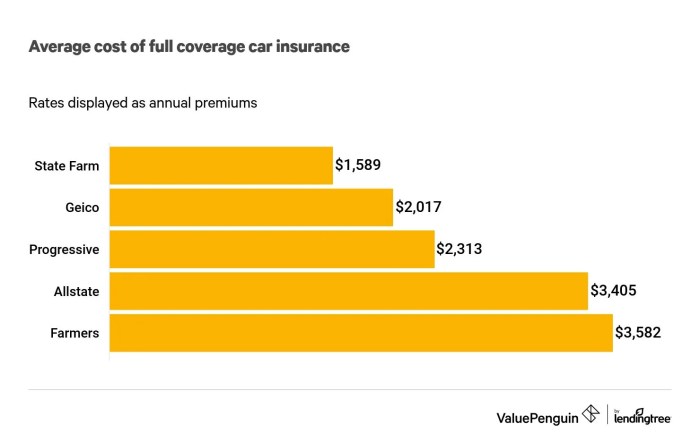

Comparison of State Farm Discounts with Competitors, State farm car insurance discount

State Farm’s discount offerings are competitive in the insurance market. Here’s a comparison of State Farm discounts with two other major car insurance providers:

| Discount Category | State Farm | Progressive | Geico |

|---|---|---|---|

| Good Driver Discounts | Yes | Yes | Yes |

| Safe Driver Discounts | Yes (Telematics Programs) | Yes (Snapshot Program) | Yes (DriveEasy Program) |

| Multi-Policy Discounts | Yes | Yes | Yes |

| Anti-theft Devices | Yes | Yes | Yes |

| Airbags | Yes | Yes | Yes |

| Daytime Running Lights | Yes | Yes | Yes |

| Eco-Friendly Vehicles | Yes | Yes | Yes |

| Student Discounts | Yes | Yes | Yes |

| Senior Discounts | Yes | Yes | Yes |

| Military Discounts | Yes | Yes | Yes |

While the general categories of discounts are similar, specific eligibility criteria and potential savings may vary. It’s important to compare quotes from multiple insurers to find the best rates for your individual needs.

Impact of State Farm Discounts on Customer Savings

State Farm’s discounts can have a significant impact on customer premiums. For example, a customer with a good driving record, a multi-policy discount, and a vehicle equipped with anti-theft devices could potentially save hundreds of dollars annually.

Consider a hypothetical customer named John, who has a clean driving record, bundles his car insurance with home insurance, and owns a car with an anti-theft system. Based on his profile and location, his estimated premium without any discounts could be $1,200 per year.

However, with the discounts mentioned above, his premium could be reduced to $900 per year, saving him $300. This illustrates how State Farm’s discounts can significantly impact affordability.

Looking for a way to save money on your car insurance? State Farm offers a variety of discounts, from good driver bonuses to safe vehicle incentives. Want to see if you qualify for these great deals? Just check out the state farm car insurance near me website to find a local agent and get a personalized quote.

With State Farm, you can get the coverage you need at a price you can afford!

The overall discount amount and its impact on affordability can vary depending on factors such as:

- Driving History:Drivers with a clean driving record typically qualify for larger discounts compared to those with accidents or violations.

- Vehicle Features:Cars with advanced safety features and anti-theft devices can lead to more substantial discounts.

- Customer Profile:Discounts for students, seniors, and military personnel can vary based on specific eligibility criteria.

- Location:Insurance premiums and discount offerings can vary by state and region.

Last Recap

In conclusion, State Farm car insurance discounts can be a valuable tool for saving money on your policy. By understanding the various categories of discounts and how to qualify for them, you can ensure you’re getting the most affordable coverage possible.

Remember, a little research can go a long way, so don’t hesitate to contact State Farm or explore their website to learn more about the discounts that might be right for you.

Clarifying Questions

How do I know which discounts I qualify for?

You can contact State Farm directly or use their online tools to check your eligibility for various discounts. They will ask about your driving history, vehicle features, and other factors.

Can I stack multiple discounts together?

Yes, in many cases, you can combine multiple discounts. However, the specific combination of discounts you can apply may vary depending on your situation.

What happens if I change my car or driving habits?

You should notify State Farm of any changes that might affect your eligibility for discounts. They will reassess your policy and update your premiums accordingly.