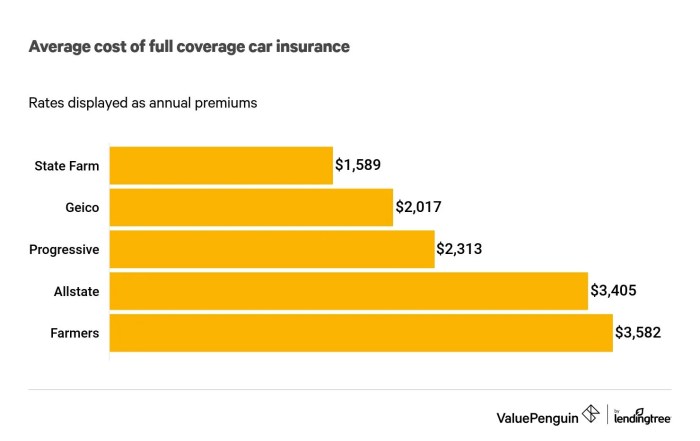

State Farm auto insurance premiums are a hot topic, especially for those seeking the best value for their coverage. This insurance giant boasts a long history, but how do their premiums stack up against the competition? Buckle up, because we’re about to explore the factors that influence your State Farm auto insurance premium, including your driving record, the type of vehicle you drive, and even where you live.

We’ll also uncover the secrets to unlocking discounts and saving money on your policy.

State Farm is known for its customer service and comprehensive coverage options, but how does it all factor into the cost? We’ll dissect the premium calculation process and compare it to other major insurers. You’ll gain valuable insights into how to make informed decisions about your auto insurance and find the best fit for your needs.

State Farm Auto Insurance: A Comprehensive Guide

State Farm is a household name in the United States, synonymous with reliable and comprehensive auto insurance. With a rich history spanning over a century, State Farm has established itself as a leading provider of insurance solutions, including auto insurance.

This article delves into the world of State Farm auto insurance, exploring its key features, premium factors, discounts, customer service, and how it stacks up against its competitors.

State Farm Auto Insurance Overview

State Farm Mutual Automobile Insurance Company, founded in 1922, is a Fortune 500 company and the largest provider of property and casualty insurance in the United States. The company’s mission is to “help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.” State Farm is known for its strong financial stability, excellent customer service, and wide range of coverage options.

State Farm’s auto insurance policies are designed to provide comprehensive protection against various risks, including accidents, theft, vandalism, and natural disasters. The company offers a variety of coverage options, including:

- Liability coverage: Protects you financially if you cause an accident that results in injuries or property damage to others.

- Collision coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive coverage: Protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal injury protection (PIP): Covers your medical expenses and lost wages if you are injured in an accident, regardless of fault.

In addition to these core coverages, State Farm offers a range of optional features, such as roadside assistance, rental car reimbursement, and accident forgiveness.

Factors Influencing State Farm Auto Insurance Premiums

Several factors determine the cost of State Farm auto insurance premiums. These factors are designed to reflect the individual risk associated with each policyholder. Here are some of the most significant factors:

- Driving history: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your premium. A clean driving record generally results in lower premiums.

- Vehicle type: The make, model, and year of your vehicle influence your premium. Expensive, high-performance vehicles are typically associated with higher premiums due to their greater repair costs and higher risk of theft.

- Location: The geographic location where you live plays a role in your premium. Areas with higher traffic density, crime rates, and accident frequency tend to have higher insurance premiums.

- Coverage levels: The amount of coverage you choose, including deductibles and limits, directly affects your premium. Higher coverage levels generally lead to higher premiums.

- Driving habits: Factors such as your age, gender, and driving habits, such as mileage and commuting patterns, are considered when calculating your premium. Young, inexperienced drivers and those who drive long distances often face higher premiums.

- Credit score: In some states, insurance companies may use your credit score as a factor in determining your premium. This practice is controversial, and some states have regulations restricting its use.

State Farm’s premium calculation methods are generally similar to those of other major insurers. They utilize a complex algorithm that considers various factors to assess the risk associated with each policyholder. However, the specific weight given to each factor may vary depending on the state and individual circumstances.

Ever wondered how State Farm calculates your auto insurance premium? Well, it’s a complex mix of factors, including your driving record, car type, and location. But if you want the ultimate protection, consider opting for state farm full coverage car insurance , which covers a wide range of incidents.

Remember, though, that full coverage often means a higher premium, so weigh the benefits against your budget and risk tolerance.

State Farm Discounts and Savings Opportunities

State Farm offers a wide range of discounts to help policyholders save on their premiums. These discounts are designed to reward safe driving habits, responsible behavior, and loyalty. Here are some of the most common discounts available:

| Discount Type | Description | Potential Savings |

|---|---|---|

| Safe Driving Discount | Rewarding drivers with clean driving records and no accidents or violations. | Up to 20% |

| Multi-Policy Discount | Bundling multiple insurance policies, such as auto, home, and life insurance, with State Farm. | Up to 25% |

| Good Student Discount | Offered to students who maintain a certain GPA or academic standing. | Up to 15% |

| Defensive Driving Course Discount | Completing an approved defensive driving course. | Up to 10% |

| Anti-theft Device Discount | Installing anti-theft devices in your vehicle. | Up to 10% |

| Paid-in-Full Discount | Paying your premium in full upfront. | Up to 5% |

To maximize your discounts and save on your State Farm auto insurance premiums, consider the following tips:

- Maintain a clean driving record: Avoid accidents, traffic violations, and DUI convictions.

- Bundle your insurance policies: Combine your auto insurance with other insurance policies, such as home or life insurance, to qualify for multi-policy discounts.

- Enroll in a defensive driving course: Completing an approved course can demonstrate your commitment to safe driving and earn you a discount.

- Install anti-theft devices: Enhancing your vehicle’s security can reduce the risk of theft and qualify you for a discount.

- Pay your premium in full: Consider paying your premium upfront to qualify for a discount.

- Shop around and compare quotes: Get quotes from other insurance companies to ensure you are getting the best rate.

State Farm Customer Service and Claims Process, State farm auto insurance premium

State Farm is known for its excellent customer service and streamlined claims process. The company provides various channels for customers to access support, including:

- Online platforms: State Farm offers a user-friendly website and mobile app for managing your policy, making payments, and filing claims.

- Phone support: You can reach State Farm’s customer service representatives 24/7 by phone for assistance with policy inquiries, claims, or other matters.

- Physical locations: State Farm has a network of local agents across the United States, providing in-person support and guidance.

The claims process for State Farm auto insurance is straightforward. Here are the general steps involved:

- Report the accident: Contact State Farm immediately after an accident to report the incident.

- Obtain an estimate: State Farm will provide you with an estimate for repairs or replacement of your vehicle.

- Receive settlement: Once the claim is processed, State Farm will issue a settlement payment for the damages.

State Farm’s customer service and claims handling have consistently received positive reviews and testimonials from customers. The company is known for its prompt response times, fair settlements, and helpful agents.

Conclusive Thoughts

Navigating the world of auto insurance can be a bit overwhelming, but understanding how State Farm premiums are calculated and what factors influence them is key to finding the best value. By exploring the various discounts available, comparing premiums, and implementing tips for saving money, you can take control of your insurance costs and ensure you’re getting the coverage you need without breaking the bank.

So, buckle up, and let’s dive deeper into the fascinating world of State Farm auto insurance premiums.

FAQ Guide: State Farm Auto Insurance Premium

What is the average State Farm auto insurance premium?

The average State Farm auto insurance premium varies depending on factors like your driving history, vehicle type, location, and coverage levels. It’s best to get a personalized quote from State Farm to determine your specific premium.

How often are State Farm auto insurance premiums reviewed?

State Farm typically reviews auto insurance premiums annually, but they may adjust premiums more frequently based on changes in your driving record, vehicle, or coverage needs. It’s a good idea to review your policy periodically to ensure you’re still getting the best rate.

Can I bundle my auto insurance with other policies for a discount?

Yes! State Farm offers multi-policy discounts for bundling your auto insurance with other policies like homeowners, renters, or life insurance. Bundling can significantly reduce your overall insurance costs.