State Farm car insurance cost is a topic that often sparks questions and concerns for drivers seeking the best coverage at the most affordable price. This guide aims to shed light on the factors influencing State Farm premiums, offering a detailed breakdown of how they calculate their rates and comparing their offerings to other major insurance providers.

Understanding the nuances of State Farm’s coverage options, potential discounts, and the impact of individual factors like driving history and credit score can empower you to make informed decisions about your car insurance needs.

Understanding State Farm Car Insurance Costs

State Farm is one of the largest and most well-known car insurance companies in the United States. It’s known for its wide range of coverage options and competitive rates. But how do you know if State Farm is the right insurer for you?

Understanding the factors that influence State Farm car insurance premiums is key to making an informed decision. This article delves into the intricacies of State Farm car insurance costs, providing insights into how rates are calculated, coverage options, and factors that impact your premiums.

Factors Influencing State Farm Car Insurance Premiums

Several factors contribute to your State Farm car insurance premiums. Understanding these factors can help you make choices that may potentially lower your costs.

- Driving History:Your driving record is a major factor in determining your premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your premiums.

- Vehicle Type:The type of car you drive plays a significant role in insurance costs. Higher-performance vehicles, luxury cars, and expensive vehicles often have higher insurance premiums due to their increased repair costs and higher risk of theft.

- Age and Gender:Younger drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents. Gender can also play a role, as statistics show that young men tend to have higher accident rates than young women.

- Location:Where you live impacts your insurance costs. Areas with higher crime rates, traffic congestion, and more frequent accidents tend to have higher insurance premiums. State Farm considers factors like population density and the frequency of claims in your area.

- Credit Score:Your credit score is increasingly being used by insurance companies, including State Farm, to assess your risk. A good credit score can often lead to lower premiums, while a poor credit score may result in higher rates.

- Coverage Options:The type and amount of coverage you choose directly affect your premiums. Comprehensive and collision coverage provide greater protection but come at a higher cost. Choosing a higher deductible can often reduce your premiums but also means you’ll pay more out of pocket in case of an accident.

How State Farm Calculates Car Insurance Rates

State Farm utilizes a complex algorithm to calculate your car insurance rates. This algorithm considers a variety of factors, including:

- Your driving history:This includes your accident and violation history, as well as the number of years you’ve been driving.

- Your vehicle information:This includes the make, model, year, and safety features of your car.

- Your location:This includes your zip code and the overall risk associated with your area.

- Your coverage choices:This includes the type and amount of coverage you choose, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Your credit score:State Farm may use your credit score as a factor in determining your rates.

State Farm’s Coverage Options

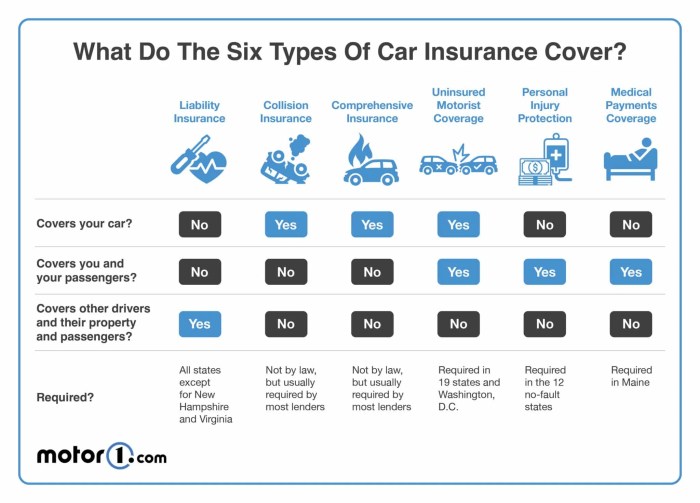

State Farm offers a variety of coverage options to meet your needs and budget. Here’s a breakdown of some of the most common coverage options:

- Liability Coverage:This coverage protects you financially if you cause an accident that injures someone or damages their property. It typically covers bodily injury liability and property damage liability. State Farm offers different limits of liability coverage, and choosing higher limits can provide greater financial protection but also increase your premiums.

- Collision Coverage:This coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s usually required if you have a car loan or lease. You can choose a deductible for collision coverage, which is the amount you pay out of pocket before your insurance kicks in.

A higher deductible typically means lower premiums.

- Comprehensive Coverage:This coverage protects you against damage to your vehicle from events other than accidents, such as theft, vandalism, fire, or hail. Like collision coverage, you can choose a deductible for comprehensive coverage. A higher deductible generally means lower premiums.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you’re injured in an accident caused by an uninsured or underinsured driver. It can help cover medical expenses, lost wages, and other damages. You can choose different limits of uninsured/underinsured motorist coverage, with higher limits providing greater financial protection.

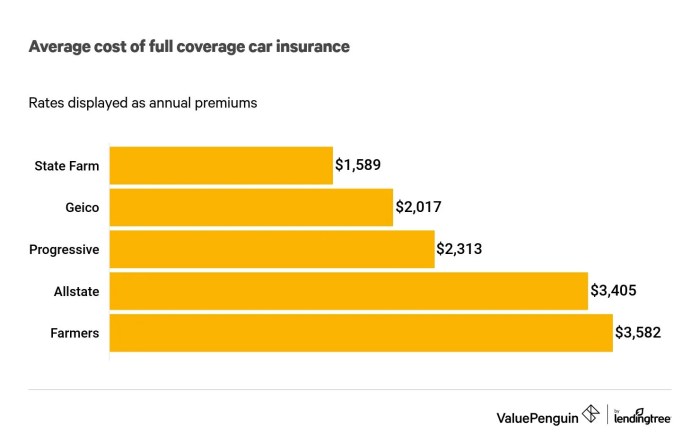

Comparing State Farm Car Insurance Costs

State Farm is known for its competitive rates, but it’s essential to compare its costs to other major insurers to find the best deal. Factors like your driving history, vehicle type, location, and coverage choices can significantly influence your rates.

Consider obtaining quotes from several insurers to compare prices and coverage options.

Average Cost of State Farm Car Insurance

The average cost of State Farm car insurance can vary significantly depending on your individual circumstances. However, here’s a general overview of average costs across different states, based on industry data:

| State | Average Annual Premium |

|---|---|

| California | $2,100 |

| Florida | $2,300 |

| Texas | $1,900 |

| New York | $2,500 |

| Illinois | $1,800 |

State Farm Discounts

State Farm offers a variety of discounts that can potentially lower your premiums. Here are some of the most common discounts:

- Good Driver Discount:This discount is awarded to drivers with a clean driving record.

- Safe Driver Discount:This discount is often offered to drivers who complete a defensive driving course.

- Multi-Car Discount:This discount is available if you insure multiple vehicles with State Farm.

- Multi-Policy Discount:This discount is offered if you bundle your car insurance with other insurance policies from State Farm, such as homeowners or renters insurance.

- Good Student Discount:This discount is available to students who maintain a certain GPA.

- Anti-Theft Device Discount:This discount is offered if your vehicle has anti-theft devices installed.

Impact of Driving History on State Farm Premiums

Your driving history is a major factor in determining your State Farm car insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your premiums.

State Farm uses a points system to assess your driving record. Each accident or violation carries a certain number of points. The more points you have, the higher your premiums will be. It’s important to note that points can stay on your driving record for several years, so even a single violation can have a long-term impact on your insurance costs.

Curious about State Farm car insurance costs? You’re not alone! Many factors go into determining your rate, like your driving history, car model, and location. If you’re ready to get a quote, simply give them a call at the state farm car insurance phone number and their friendly agents can answer any questions you have about their coverage options and help you find a policy that fits your budget.

Role of Vehicle Type, Age, and Location

The type of car you drive, your age, and your location also play a significant role in determining your State Farm car insurance premiums.

- Vehicle Type:As mentioned earlier, higher-performance vehicles, luxury cars, and expensive vehicles often have higher insurance premiums due to their increased repair costs and higher risk of theft. State Farm considers factors such as the vehicle’s safety features, its history of accidents, and its theft rate.

- Age:Younger drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents. State Farm may consider your age and driving experience when calculating your rates.

- Location:Where you live impacts your insurance costs. Areas with higher crime rates, traffic congestion, and more frequent accidents tend to have higher insurance premiums. State Farm considers factors like population density and the frequency of claims in your area.

Influence of Credit Score and Coverage Choices

Your credit score and coverage choices can also influence your State Farm car insurance premiums.

- Credit Score:State Farm, like many other insurers, may use your credit score as a factor in determining your rates. A good credit score can often lead to lower premiums, while a poor credit score may result in higher rates.

This practice is based on the idea that people with good credit are more financially responsible and may be less likely to file claims.

- Coverage Choices:The type and amount of coverage you choose directly affect your premiums. Comprehensive and collision coverage provide greater protection but come at a higher cost. Choosing a higher deductible can often reduce your premiums but also means you’ll pay more out of pocket in case of an accident.

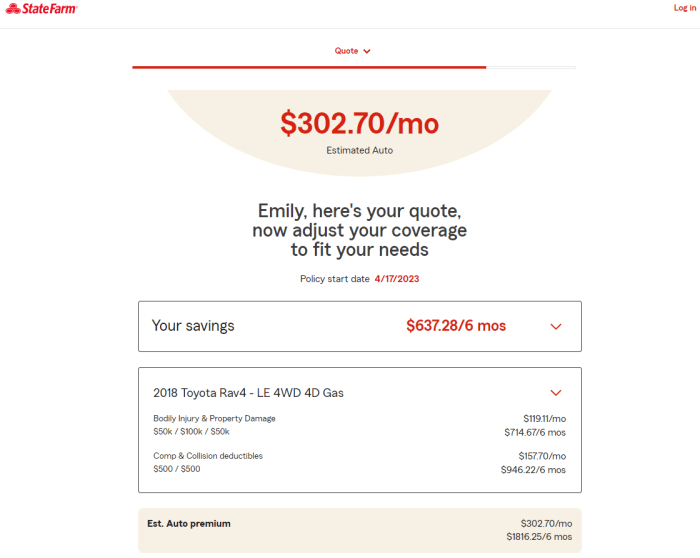

Obtaining a State Farm Car Insurance Quote

Getting a State Farm car insurance quote is a straightforward process. Here’s a step-by-step guide:

- Visit State Farm’s website:Go to the State Farm website and click on the “Get a Quote” button.

- Provide your information:You’ll need to provide basic information about yourself, your vehicle, and your driving history.

- Choose your coverage options:Select the type and amount of coverage you want.

- Review your quote:State Farm will provide you with a customized quote based on your information and coverage choices.

Tips for Getting the Best Possible Rate from State Farm, State farm car insurance cost

Here are some tips to help you get the best possible rate from State Farm:

- Shop around:Get quotes from multiple insurers to compare prices and coverage options.

- Improve your driving record:Avoid accidents and traffic violations to keep your premiums low.

- Consider a higher deductible:Choosing a higher deductible can often reduce your premiums, but be sure you can afford to pay it out of pocket in case of an accident.

- Bundle your insurance policies:If you have multiple insurance policies, such as homeowners or renters insurance, consider bundling them with State Farm to get a multi-policy discount.

- Ask about discounts:State Farm offers a variety of discounts, so be sure to ask about them when you get a quote.

State Farm Car Insurance Packages

State Farm offers a variety of car insurance packages to meet your needs and budget. Here’s a table comparing some of the most common packages and their features:

| Package | Features | Price Range |

|---|---|---|

| State Farm Basic | Liability, collision, comprehensive | $1,500

|

| State Farm Preferred | Liability, collision, comprehensive, uninsured/underinsured motorist | $2,000

|

| State Farm Premier | Liability, collision, comprehensive, uninsured/underinsured motorist, roadside assistance, rental car reimbursement | $2,500

|

State Farm Car Insurance Customer Reviews and Ratings

State Farm consistently receives high customer satisfaction ratings. Customers praise the company’s friendly and helpful customer service, efficient claims handling process, and competitive rates. However, some customers have reported issues with claims processing delays and difficulty getting in touch with customer service representatives.

It’s important to read customer reviews and ratings from multiple sources to get a balanced perspective.

Comparing State Farm’s Customer Service and Claims Handling

State Farm’s customer service and claims handling processes are generally considered to be above average. The company offers a variety of ways to contact customer service, including phone, email, and online chat. State Farm’s claims process is designed to be straightforward and efficient.

However, it’s important to note that individual experiences can vary.

Benefits and Drawbacks of Choosing State Farm Car Insurance

Choosing State Farm car insurance offers several benefits, including competitive rates, a wide range of coverage options, and a strong reputation for customer service. However, it’s important to consider the potential drawbacks, such as potential issues with claims processing delays and customer service accessibility.

Closing Summary: State Farm Car Insurance Cost

Navigating the world of car insurance can feel like a maze, but armed with knowledge and a clear understanding of your needs, you can confidently choose a policy that fits your budget and provides the protection you deserve. State Farm offers a variety of options, and by carefully considering your unique circumstances and exploring available discounts, you can find a policy that meets your specific requirements.

FAQs

What factors affect State Farm car insurance costs?

State Farm considers various factors, including your driving history, age, vehicle type, location, credit score, and the coverage options you choose.

How do I get a State Farm car insurance quote?

You can easily obtain a quote online, over the phone, or by visiting a local State Farm agent. Be prepared to provide information about your vehicle, driving history, and desired coverage.

Are there any discounts available with State Farm car insurance?

Yes, State Farm offers a range of discounts for good drivers, safe vehicles, multi-policy holders, and more. Be sure to inquire about available discounts when getting a quote.